From Paycheck to Prosperity:

A Full-Day

Money Mastery Programme

Join us for this Cashflow Playbook workshop, where we’ll show you how to take control of your money, break free from financial stress, and build lasting wealth. Learn practical strategies to manage your cashflow with confidence—without feeling restricted or overwhelmed. Walk away with a clear plan to make smarter financial decisions and start thriving, not just surviving.

What You'll Learn?

Make room to invest, pay off debt, and still live well

Optimise your existing income to work harder for you

Create a spending & saving plan aligned with your life goals

Identify and plug money leaks (most people don’t even realise where the money is going!)

Stop financial guesswork and replace it with clarity, confidence, and control

👉 Whether you earn a lot or just enough, cash flow is the engine that drives your dreams.

If it’s leaking, stuck, or mismanaged—you stay stuck too.

This full-day workshop is designed to FIX THAT!

Event Details

- 15th November 2025

- 10:00 AM - 5:00 PM

- FA Advisory HQ, Suite 29-6, Level 29, Menara 1 Mont Kiara

-

Early Bird Promo: RM 699 + 8% SST/pax

NP: RM 999+ 8% SST/pax

Valid till 9th November 2025!

NP: RM 999+8%SST!

What We'll Cover For The Day..

Module 1: The Money Mindset Reset

- Understand why most budgets fail (and how to fix yours).

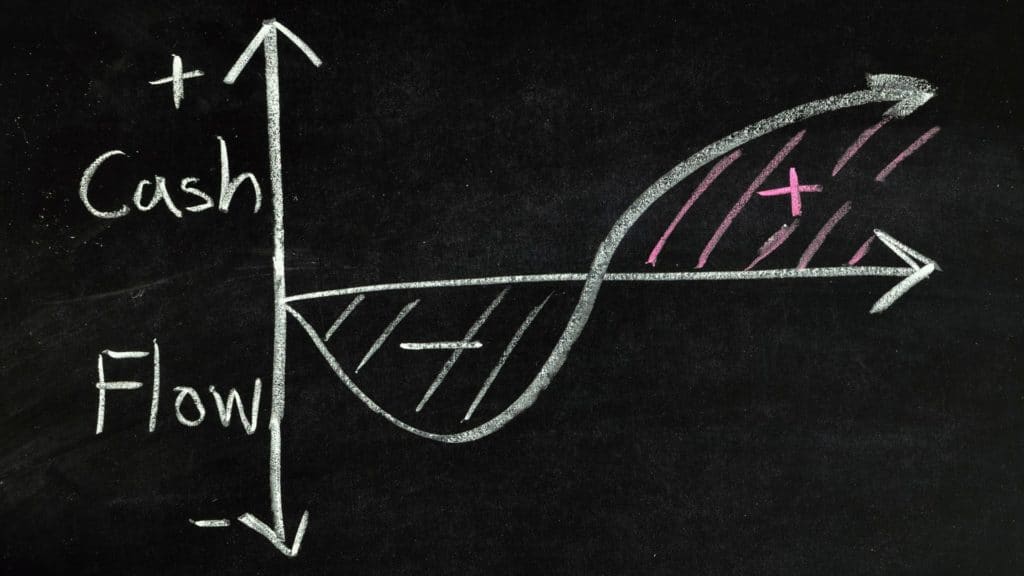

- Cashflow vs. income: The real key to financial freedom.

- Activity: Track your last 3 months—where did the money REALLY go?

Module 2: Net Worth = Your Financial GPS

- Why net worth matters more than salary.

- How to calculate yours (assets vs. liabilities)

- Case Study: How two couples with the same income have VERY different net worth.

Module 3: Budgeting That Doesn’t Suck

- The 50/30/20 rule—flexible budgeting for real life.

- Pay Yourself First” strategy (the secret to guilt-free spending).

- Tools & apps to automate your finances.

Module 4: Board Game & Realization

- Participants play in groups – each “life choice” affects their cash flow, goals, and net worth

- Optional side tasks:

– Investment decisions

– Emergency fund challenges

– Debt or lifestyle upgrades - Debrief & Reflection

– What did the game reveal about your money habits?

– What would you do differently in real life?

Module 5: Action Planning

- Identify top 3 cash flow leaks or missed opportunities

- Set 1 SMART financial goal (short-term or long-term)

- Choose 1 habit to change starting tomorrow

- Introduce accountability tools (trackers, money date, planner)

Who Should Attend?

You’re Earning Well, But Something Feels Off

- You have a steady income (or even a high one), but your savings aren’t growing

- You’ve dabbled in investing, but it feels unstructured or inconsistent

- You want to make sure your money is working harder for your long-term goals

You’re Constantly Wondering Where Your Money Went

- You often feel like your income disappears too quickly

- You’re tired of the paycheck-to-paycheck cycle

- You want to stop stressing about unexpected expenses and start planning with confidence

You’re a Couple Trying to Get on the Same Financial Page

- You’re engaged, married, or in a long-term partnership and want to avoid money fights

- You’re unsure how to split responsibilities or align goals

- You want to build a joint future—home, kids, early retirement—without financial friction

You’re a Freelancer or Side Hustler With Variable Income

- Your income isn’t fixed and that makes budgeting tough

- You want to smooth out your finances so you can plan like a pro

- You’re looking for structure without losing your flexibility

Change your cashflow game for the better at our workshop!

- Your cash flow will no longer feel like a burden—it becomes your launchpad for wealth, security, and freedom.

- You’ll leave with a clear, personalised roadmap to start building the life you’ve always envisioned—faster and with less stress.

- Led by 2 Licensed Financial Planners & Accredited Trainers, this workshop is fun & interactive, practical and designed for real-life results.

Early Bird: RM 699 only

Normal Price: RM 999 only

Exclusive Bonus Materials!

- Exclusive Workbook – With fillable templates (cashflow tracker, net worth calculator, budget planner).

- 90-Day Money Challenge – Weekly actions to lock in new habits.

- Private Community Group – For ongoing support & Q&A.

- Unlimited returns for this Masterclass

Total Worth of RM 3,998!

Meet Your Expert Trainers

When it comes to money and relationships, getting the right guidance makes all the difference. Meet Pauline Teoh & Vivian Chow, two seasoned licensed financial planners who bring years of industry experience, expertise, and passion to help couples like you take control of their finances—together.

Pauline Teoh

The Financial Architect for Women & Families

With over 20 years of experience across global FMCG, market research, and financial services, Pauline Teoh is dedicated to helping individuals and families achieve their life goals through structured financial planning and coaching.

Pauline specializes in personal finance for professional women and families with special needs children, offering neutral, unbiased, and customized financial solutions.

She has helped more than 100 families gain financial clarity and freedom. Over the last five years, she has also conducted financial literacy sessions for SMEs and MNCs, empowering professionals with the tools they need to build wealth and secure their future.

With a deep understanding of behavioral finance, Pauline not only focuses on numbers but also on changing mindsets and building positive financial habits.

Vivian Chow

The Expert in Money Psychology & Behavioral Finance

Vivian brings a unique blend of financial expertise, money psychology, and behavioral finance to her training programs.

Vivian is passionate about empowering individuals and couples to understand their financial biases, make smarter money decisions, and develop healthy financial habits.

Her deep understanding of money psychology and financial stress management allows her to teach not just financial strategies, but also practical tools to manage financial anxiety and improve mental well-being.

Through her engaging sessions, Vivian helps participants gain a strong financial foundation while overcoming limiting beliefs and emotional barriers to wealth building.

What Our Clients Say About Pauline & Vivian

What participants say about our masterclass

Event Details

- 15th November 2025

- 10:00 AM - 5:00 PM

- FA Advisory HQ, Suite 29-6, Level 29, Menara 1 Mont Kiara

-

Early Bird Promo: RM 699 + 8% SST/pax

NP: RM 999+ 8% SST/pax

Valid till 9th November 2025!

NP: RM 999+8%SST!

Frequently Asked Questions

Click on the Registration link here to register and make payment. Once you have successfully completed the payment, please do send us a copy of the receipt to events@fa.my or WhatsApp at 03-6211 4011.

If you wish to claim HRDC Fund, please register here, and we will contact you for the application process.

You can make payment via FPX Interbank Transfer, Credit Card (Visa/Master), or e-Wallet (TouchnGo, GrabPay, ShopeePay, Boost).

Training notes and assessments will be provided to all participants at the workshop.

Yes! You will receive an exclusive workbook with fillable templates to track your budgeting, cashflow and net worth. You will also have weekly check-ins with Pauline & Vivian for your 90-Day money challenge, a private community group for ongoing support and Q&A, and unlimited returns to this masterclass.

Tickets purchased are not refundable. However, you may reschedule to attend at a different date or transfer your ticket to another participant.

If you wish to organise a private or in-house session for your staff/employees, please reach out to us via email events@fa.my or WhatsApp us at 03-62114011

Pauline Teoh has over 10 years of experience in financial services, corporate leadership, and coaching, Pauline has helped over 100 families achieve financial breakthroughs. She is licensed by Bank Negara Malaysia & Securities Commission. Specializes in financial planning for professional women & families, and is an expert in financial literacy & coaching for couples. Pauline understands that every couple has unique financial challenges—and she’s here to help you create a plan that works for both of you.

Vivian also has over a decade of experience in financial services. She is passionate about helping couples understand their financial behaviors and biases. Vivian is a licensed financial planner & behavioral finance specialist, who focuses on money psychology & financial stress management. She teaches couples how to build wealth while protecting their mental well-being. Together, Pauline & Vivian have helped over 500 individuals and families take control of their finances and live the life they want.

FA Advisory is a Leading Financial Planning and Advisory Firm in Malaysia, licensed by the Securities Commission and Bank Negara Malaysia. Besides providing comprehensive and impartial advice, FA Advisory is also a HRDC Registered Training Provider offering various financial literacy training programs to individuals and corporations.

You can email us at events@fa.my or WhatsApp to 603-62114011

Yes, we have various courses on Personal Finance, Couple Financial Planning, Taxation, Leadership, Effective communications, and others. Feel free to reach out to us if you are interested to find out about these other courses.

REGISTER TODAY!

Take charge of your cashflow today! – Book your ticket now!

Online Payment

Register & Pay

HRDC Claim

Register HRDC Claim

Need assistance?

Contact us via email at events@fa.my or send us a message on WhatsApp at 03-6211 4011

Copyright © 2025 FA Advisory Sdn Bhd (Co. Reg. No. 200901022427). All Rights Reserved.