The latest KWSP account restructuring in Malaysia took place on May 11, 2024. It applies to all members under the age of 55. Here’s a breakdown of the key changes and what exactly you can do in regards to the account restructuring:

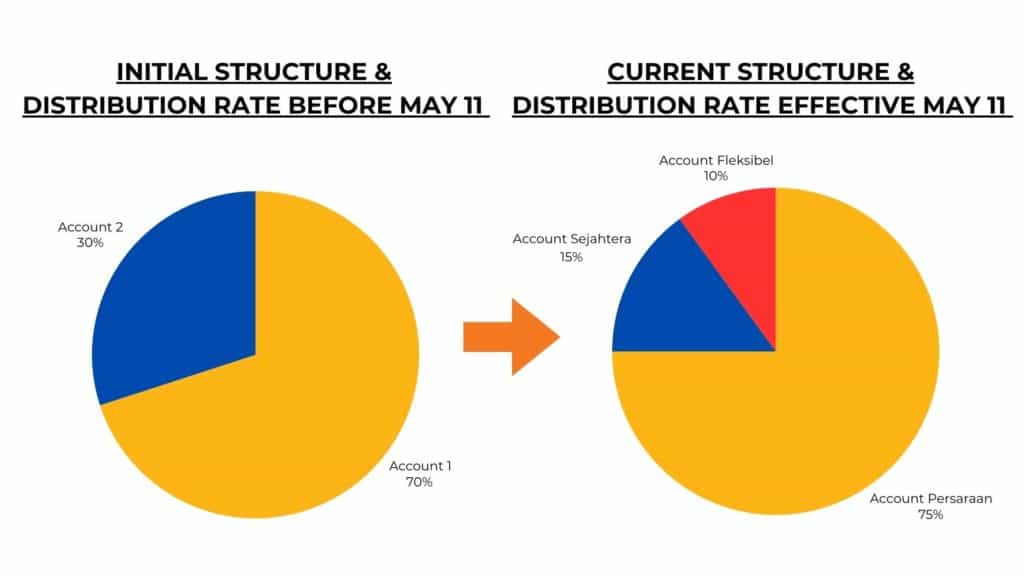

Three accounts instead of two: Previously, you had Account 1 and Account 2. Now, there are three:

- Akaun Persaraan: aka Account 1. Meant for retirement and is not accessible until you reach retirement age.

- Akaun Sejahtera: aka Account 2. Can be used for your pre-retirement needs, such as Housing, Education, Medical, Insurance Protection/ Takaful, Hajj, and age 50 withdrawal.

- Akaun Fleksibel: The new account for short-term needs. You can withdraw funds from here, for any emergency cash needs.

Contribution allocation changes:

With the new changes implemented, your contributions will be split between the three accounts: 75% to Akaun Persaraan, 15% to Akaun Sejahtera, and 10% to Akaun Fleksibel.

So what is the significance of this change?

Well, this initiative prioritizes empowering Malaysians to navigate their financial journey with confidence. Aligning financial aspirations with life stages, and addressing short-term financial needs to ensure long-term well-being.

How does Akaun Fleksibel work?

Akaun Fleksibel is designed to meet members’ short-term financial needs. Savings in Akaun Fleksibel can be withdrawn once per day, with a minimum withdrawal amount of RM50 per day.

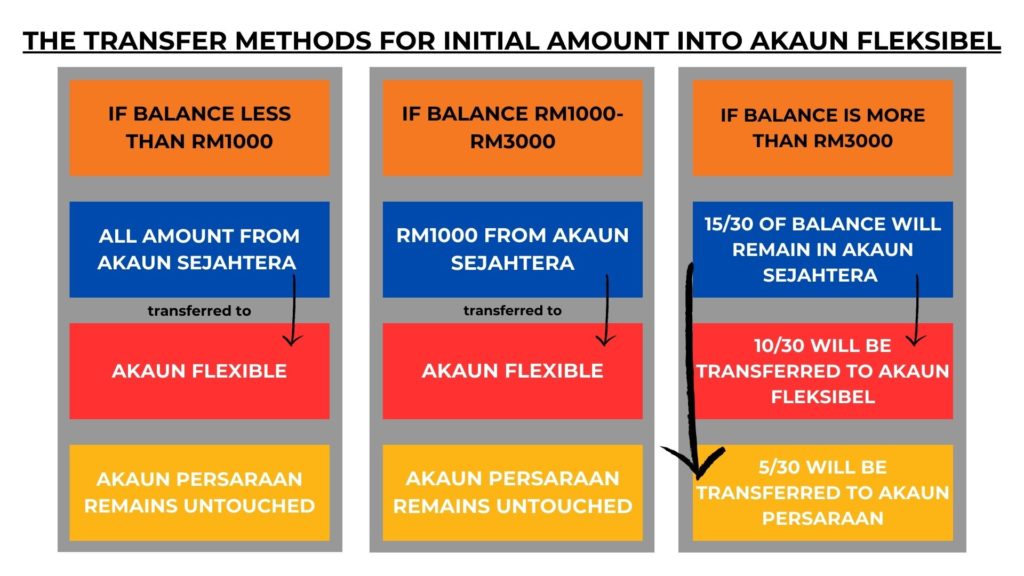

Members who are below 55 years old can opt for the initial amount transfer starting from 12 May 2024 until 31 August 2024. This application can only be made once during the period and cannot be canceled.

The determination of this initial amount in Akaun Fleksibel is subject to the savings balance in Akaun Sejahtera.

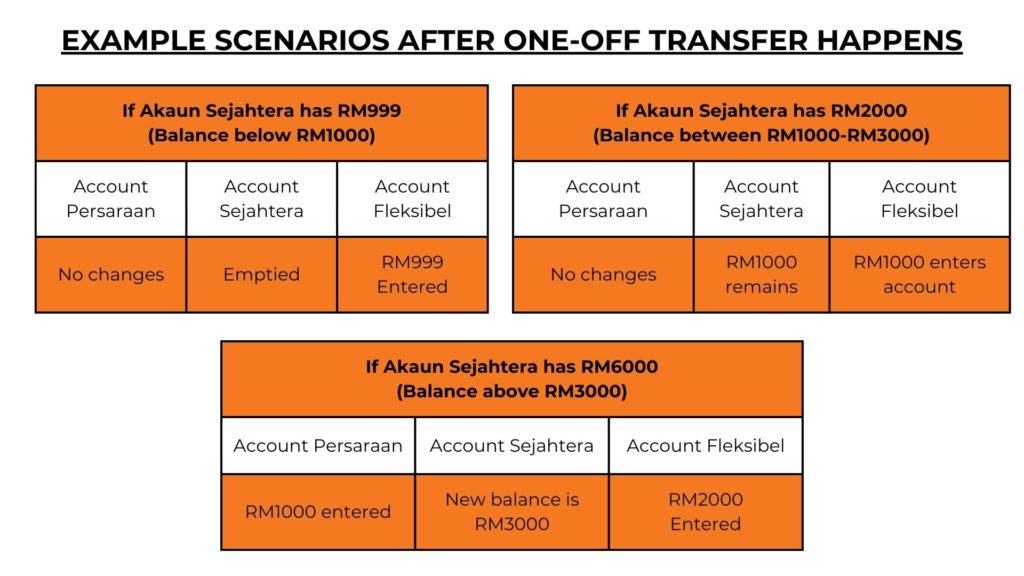

- For balances below RM 1,000: The full amount is moved to Akaun Fleksibel

- For balances between RM1,000 and RM3000: RM 1,000 is moved to Akaun Fleksibel

- For balances above RM3,000: 5/30 of it is moved to Akaun Persaraan, 15/30 of it remains in Akaun Sejahtera, and 10/30 of it is moved to Akaun Fleksibel.

Can I transfer savings from Account Flexible to Account Persaraan or Account Sejahtera?

Let’s say that you prefer to save all of your EPF contributions for your retirement and want to move the savings in Account 3 to Account 2 or/and Account 1. Yes, you can do so but do note that this is a one-way transfer.

In other words, you would not be able to revert the money that you have transferred from Account 3 to Account 2 or Account 1. Furthermore, you have to physically visit an EPF branch to submit your application to perform the transfer.

Is the dividend rate affected in any way due to this change?

No matter which account your savings are in (Retirement, Long-Term Savings, or Flexible), you’ll earn the same dividend rate!

For example, if EPF announces a 5.5% dividend rate, all three accounts will benefit from that same 5.5% return. The actual amount of money you earn in dividends depends on two things:

- How much money you have in each account: The more you have saved, the bigger the dividend payout.

- How long the money has been there: The longer your savings sit in the account, the more they contribute to your overall dividend earnings.

So what should you do?

If you were to ask us? We’d say don’t touch your account flexible money.

Akaun Fleksibel offers convenient access to funds for emergencies, which can be a lifesaver in unexpected situations. However, it’s important to use it strategically to maximize your long-term financial security.

Here’s why:

- Reduced Growth Potential: Each withdrawal means you miss out on EPF’s high dividends and compounding interest. Over time, this can significantly impact your retirement savings.

- Planning for the Future: While Malaysia’s life expectancy is around 75, you might live much longer. Let’s say you retire at 55 and need RM1,000 per month. To support yourself for 20 years (until age 75), you’d need approximately RM240,000. Withdrawing from your Flexible Account can reduce the amount available for your golden years.

Here are some resources from KWSP for more information:

KWSP Account Restructuring: https://www.kwsp.gov.my/account-restructuring

A Quick Guide to EPF Account Restructuring: https://www.kwsp.gov.my/