In the uncertain world we live in, financial security has become more crucial than ever, especially in Malaysia where economic fluctuations can have a significant impact on personal finances. An emergency fund acts as a financial safety net, protecting you from unexpected expenses and providing peace of mind. In this article, we’ll explore why creating an emergency fund is essential and provide practical steps to help you build one effectively.

Why You Need an Emergency Fund

- Protection Against Unexpected Expenses

Life is unpredictable. Whether it’s a sudden medical emergency, car repair, or job loss, having an emergency fund ensures you can handle these surprises without derailing your financial stability. In Malaysia, where healthcare costs and living expenses can be high, an emergency fund can be a lifesaver.

- Avoiding Debt

Without a financial cushion, unexpected expenses often lead to debt. Credit cards and personal loans might seem like quick fixes, but they come with high-interest rates that can compound your financial problems. An emergency fund helps you avoid falling into this debt trap.

- Peace of Mind

Financial stress can take a toll on your mental and physical health. Knowing you have a safety net allows you to face life’s uncertainties with confidence and focus on your long-term financial goals without constant worry.

How to Build an Emergency Fund

- Set a Realistic Goal

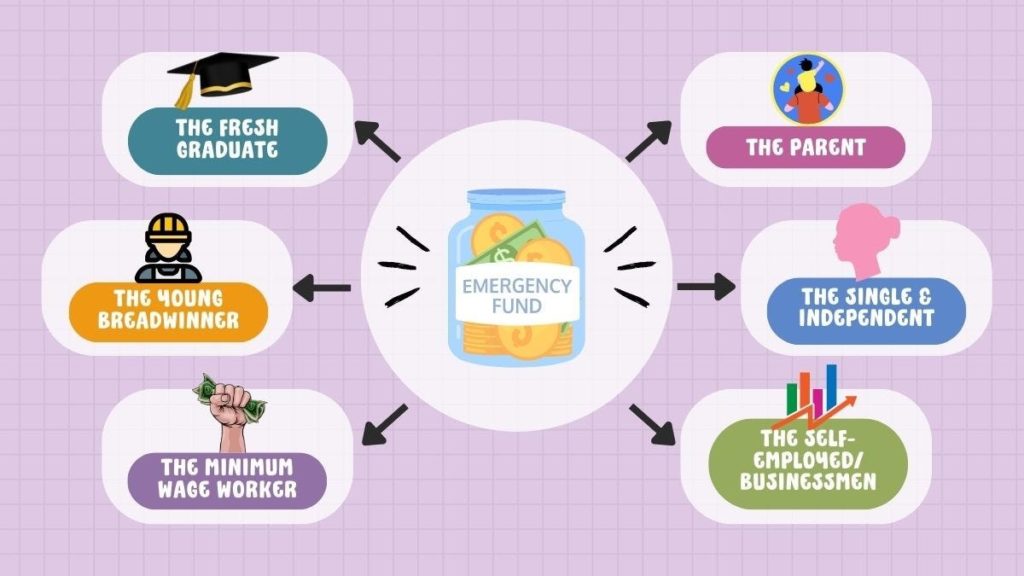

Determine how much you need to save. A good rule of thumb is to have three to six months’ worth of living expenses in your emergency fund. This amount can vary depending on your personal circumstances, such as family size, income stability, and existing debts.

- Create a Budget

A well-planned budget is the foundation of any financial strategy. Start by tracking your income and expenses to understand your spending habits. Identify areas where you can cut back and allocate those savings to your emergency fund.

- Automate Your Savings

Automating your savings can make the process easier and more consistent. Set up a monthly automatic transfer from your main account to a separate, easily accessible savings account designated for emergencies. This way, saving becomes a regular part of your financial routine.

- Prioritize and Adjust

While building your emergency fund, prioritize it over other non-essential expenses. This might mean delaying a vacation or dining out less frequently. Remember, the goal is to build a buffer that protects you from future financial shocks.

- Earn Extra Income

If possible, consider ways to earn additional income. This could be through freelance work, a part-time job, or selling unused items. Direct this extra income straight into your emergency fund to reach your goal faster.

- Review and Adjust Regularly

Your financial situation and needs can change over time. Review your emergency fund periodically and adjust your savings goal as necessary. Life events like a new job, moving, or expanding your family might require you to increase your fund.

Practical Tips for Malaysians

- Use High-Interest Savings Accounts: Look for savings accounts with high-interest rates to maximize your emergency fund’s growth. Banks in Malaysia offer various options, so shop around for the best rates.

- Leverage Technology: Use financial apps to track your spending and savings. Apps like Touch ‘n Go eWallet and Boost can help you manage your finances more effectively.

- Stay Informed: Keep up with economic news and financial advice specific to Malaysia. Understanding the local economic climate can help you make better financial decisions.

Conclusion

Building an emergency fund is a crucial step towards financial stability and peace of mind. By understanding its importance and following these practical steps, you can create a financial buffer that protects you and your family from unexpected challenges. Start today and take control of your financial future.

Disclaimer: This article reflects my personal views and experiences as a Licensed Financial Planner. It does not represent the opinions or positions of any company or third party.

About the Author

Dr. Rajendaran Vairavan is a Licensed Financial Planner with CFP certification and a seasoned practitioner in the financial planning industry. Dr. Rajendaran writes insightful articles focusing on personal finance, investment strategies, and wealth management. With extensive expertise in the field, he offers practical advice to help readers build a secure financial future. Connect with him on LinkedIn to stay updated on his latest financial insights.