Imagine life throws you a curveball, and you can’t be there for your loved ones financially. Life insurance can be a safety net in those tough times. It’s basically an agreement between you and an insurance company. You pay regular amounts (premiums) to build a safety net. If the unexpected happens, like death, disability, or other situations covered by the policy, a lump sum of money gets paid out to your loved ones. This helps them weather the storm and keeps your family financially protected.

No matter your life stage, from single to married with kids, life insurance can be a valuable tool.

For those who are single: Life insurance isn’t just about protecting yourself financially. Many of us have loved ones we care for, like aging parents or younger siblings. Having life insurance ensures they wouldn’t face financial hardship if you were no longer around.

As you move into marriage: That commitment to support each other takes on a new layer. Life insurance becomes a way to solidify that promise, providing financial security for your spouse and even children if you’re not there.

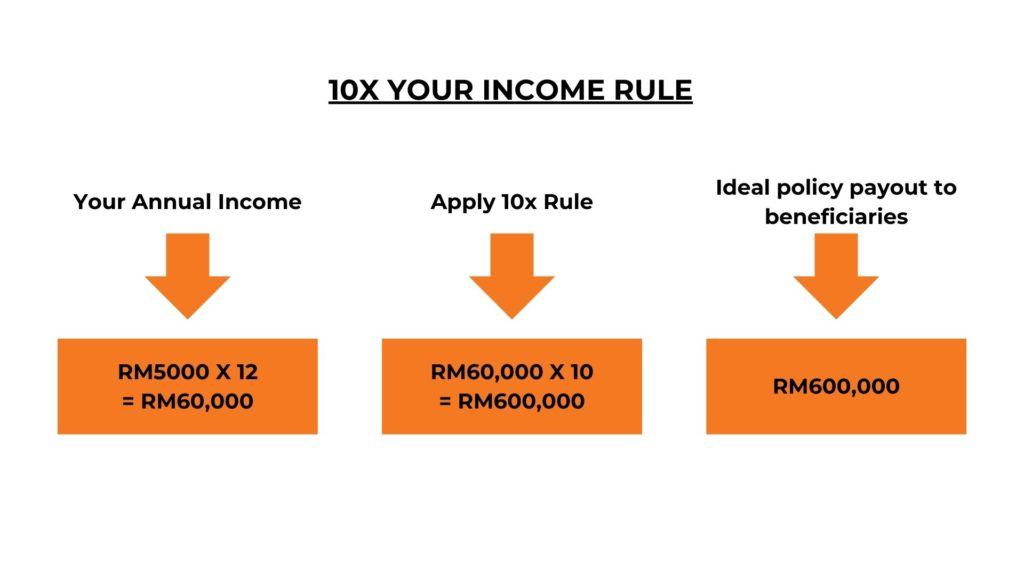

Figuring out how much life insurance you need can be tricky. But one common starting point is the “10 times your income rule.”

This basically means your life insurance benefit should be around 10 times what you earn in a year.

Let’s break it down with an example: Say you make RM60,000 annually. Following the 10x rule, your ideal coverage would be RM60,000 x 10 = RM600,000. So, you’d want a life insurance policy that pays out RM600,000 to your beneficiaries if something happens to you.

Remember, this is just a starting point. Your actual life insurance needs will depend on your specific situation, like your dependents and financial obligations.

Determining your life insurance coverage:

- Family first: Think about your spouse, kids, or any loved ones who depend on your income. Their needs should be a major factor in your coverage amount.

- Don’t forget debts: Outstanding loans can be a huge burden on your loved ones. Consider a policy that would help pay those off if you’re no longer around.

- Looking ahead: Life insurance can help secure your loved ones’ futures. Think about college funds for your kids or helping your spouse maintain a comfortable retirement. The right policy can make a big difference.

In conclusion, life insurance offers a valuable tool for individuals and families to ensure long-term financial security. By carefully considering factors like dependents, debts, and future goals, individuals can determine the appropriate coverage level to safeguard their loved ones in the event of an unexpected passing, disability, or other covered event. Consulting with a qualified financial advisor can further assist in navigating the life insurance landscape and selecting a policy that aligns with your specific needs and risk tolerance. Taking a proactive approach to life insurance planning demonstrates a commitment to responsible financial stewardship and provides peace of mind for you and your beneficiaries.

For more personalized advice on how much coverage you should get, chat with one of our wealth advisors here.