It is common for people to focus on investment and insurance after settling down in one’s career but NOT estate planning. The reason is: too young and too early to have an estate plan.

But is this wise? Most are aware of uncertainty of life but do not readily accept that life can be fragile. It cannot be denied that passing on without estate plan is expensive.

If someone passes on without a Will, his wealth accumulated throughout the lifetime may not be passed to whom he wishes or may end up in the wrong hands. Or it may cause family disputes/fighting because everyone is trying to get a piece from the estate. It is important to start your financial planning from estate planning.

Common reasons why people delay estate planning:-

It must be emphasised that an estate plan represents us when we are no longer around to care for our family members. It should not be just a legal document, or just a document to distribute assets; it also a document to carry on and convey our love and our expression of endearment to whom dear to us. It will always be the quintessential and even spiritual support for those near and dear to us to continue their life peacefully in the days ahead without us.

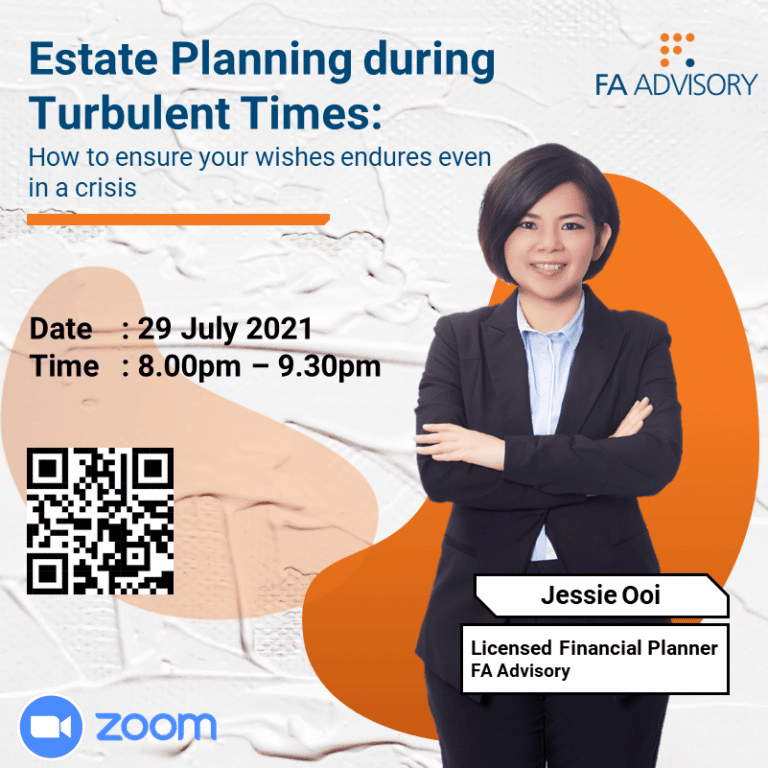

This webinar is part of the financial empowerment series organised by FA Advisory Sdn Bhd, a financial advisory firm licensed by Bank Negara and Securities Commission Malaysia.

Copyright © 2013-2022 FA Advisory Sdn Bhd Co. All Rights Reserved.

Copyright © 2013-2022 FA Advisory Sdn Bhd Co.

All Rights Reserved.

There are unscrupulous parties misusing the Name & Logo of FA Advisory on social media to offer investment scheme promising high returns, with the intention to defraud.

We wish to clarify that, FA Advisory Sdn Bhd is a Licensed Financial Planning & Advisory Firm, and we DO NOT offer any guaranteed investment packages. We also DO NOT collect investment monies from clients directly. We only deal with licensed and legitimate investment products.